vermont state tax rate 2021

August 6 2021 2021-1479 The Vermont Department of Labor announced that its fiscal year 2022 July 1 2021 June 30 2022 state unemployment insurance SUI tax rates are determined on Rate Schedule III with rates ranging from 08 to 65 up from fiscal year 2021 where Rate Schedule I applied with rates ranging from 04 to 54. If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically.

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

There are a total of 205 local tax jurisdictions across the state collecting an average local tax of 0093.

. Learn about our editorial policies. Employers will receive an assessment or tax rate for which they have to pay. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be.

There is an unlimited marital deduction so you can transfer unlimited assets to your spouse without incurring any estate tax exposure. 400 1000. Overall state tax rates range from 0 to more than 13 as of 2021.

TAXES 17-13 Vermont State Income Tax Withholding. The South Burlington sales tax rate is. Tuesday January 25 2022 - 1200.

State Individual Income Tax Rates and Brackets 2021 Single Filer Married Filing Jointly Standard Deduction Personal Exemption. 2022 Income Tax Withholding Instructions Tables and Charts. The Marital Deduction - QTIPs.

In addition to the Vermont state estate tax we also have the federal estate tax in the United States. Estates worth less than this amount are not subject to the estate tax in the state of Vermont. The tax only applies to estates valued at more than the exemption.

For a married person a major estate tax benefit is the ability to transfer. The minimum combined 2022 sales tax rate for South Burlington Vermont is. Tax Withholding Table.

As of January 1 2021. 2021 VT Rate Schedules. The first 5 million in an estate is exempt and is not subject to the estate tax.

Alabama a b c 200 0. The federal estate tax exclusion is portable so a surviving. In 2021 the exclusion is 117 million and the maximum rate is 40 percent.

Detailed Vermont state income tax rates and brackets are available on this page. Average Sales Tax With Local. Or Civil Union Filing Separately of the amount over If VT Taxable.

An Official Vermont Government Website. Meanwhile total state and local sales taxes range from 6 to 7. Income Tax Rate Schedules Tax Rate Schedules 2021 Vermont Tax Rate Schedules Single Individuals Schedule X Use if your filing status is.

Unlike the federal estate tax system Vermont does not permit the portability of credits. Vermont Estate Tax Exemption. The tax rates are updated periodically and might increase for businesses in certain industries that have higher rates of turnover.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. 2021 VT Tax Tables. 2021 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

Check the 2021 Vermont state tax rate and the rules to calculate state income tax 5. Free sales tax calculator tool to estimate total amounts. She leverages this background as a fact checker for The Balance to ensure that facts cited in articles are accurate and appropriately sourced.

Look up 2021 Vermont sales tax rates in an easy to navigate table listed by county and city. State State Sales Tax Rate Rank Avg. As you can see your Vermont income is taxed at different rates within the given tax brackets.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. SUTA tax rates will vary for each state.

Employers pay two types of unemployment taxes. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Exemptions to the Vermont sales tax will vary by state.

The threshold for the Vermont estate tax is 5 million as of 2021. The Amount of Vermont Tax Withholding Should Be. With proper planning a married couple will be able to shelter 10 million from Vermont estate tax starting in 2021.

A financial advisor in Vermont can help you. This is the total of state county and city sales tax rates. State and Federal Unemployment Taxes.

The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. Single If VT Taxable Income is Over But Not Over VT Base Tax is Plus Married Filing Separately Schedule Y-2 Use if your filing status is. Local Sales Tax Rate a Combined Sales Tax Rate Rank Max Local Sales Tax Rate.

The Vermont sales tax rate is currently. Vermont has no cities that levy a local income tax. Pay Period 06 2017.

State Rates Brackets Rates Brackets Single Couple Single Couple Dependent. 2021 State Income Tax Rates and Brackets. Tax Year 2021 Personal Income Tax - VT Rate Schedules.

Each state has a range of SUTA tax rates ranging from 065 to 68. State unemployment taxes are paid to this Department and deposited into a trust fund that can only be used for the payment of benefitsThe state tax is payable on the first 15500 in wages paid to each employee during a calendar year. Location is everything if you want to save a few income tax dollars.

7 rows Taxable Income Is. The County sales tax rate is. On or after January 1 2021 the exemption rises to 50 million.

Calculate your state income tax step by step 6. Plan the correct withholding rate is 6 of the deferred payment. 2021 State.

Vermont Income Tax Calculator Smartasset

Vermont Tax Forms And Instructions For 2021 Form In 111

What To Know About Vermont S Property Transfer Tax Vhfa Org Vermont Housing Finance Agency

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Understanding Your Tax Bill Department Of Taxes

Vermont Department Of Taxes Notice Of Changes Sample 1

Vermont Income Tax Calculator Smartasset

Vermont State Tax Information Support

Vermont Income Tax Calculator Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Personal Income Tax Department Of Taxes

Vermont Income Tax Brackets 2020

Discover 14 Of The Most Fun And Interesting Facts On Vermont Economic Ones Too

Vermont Estate Tax Everything You Need To Know Smartasset

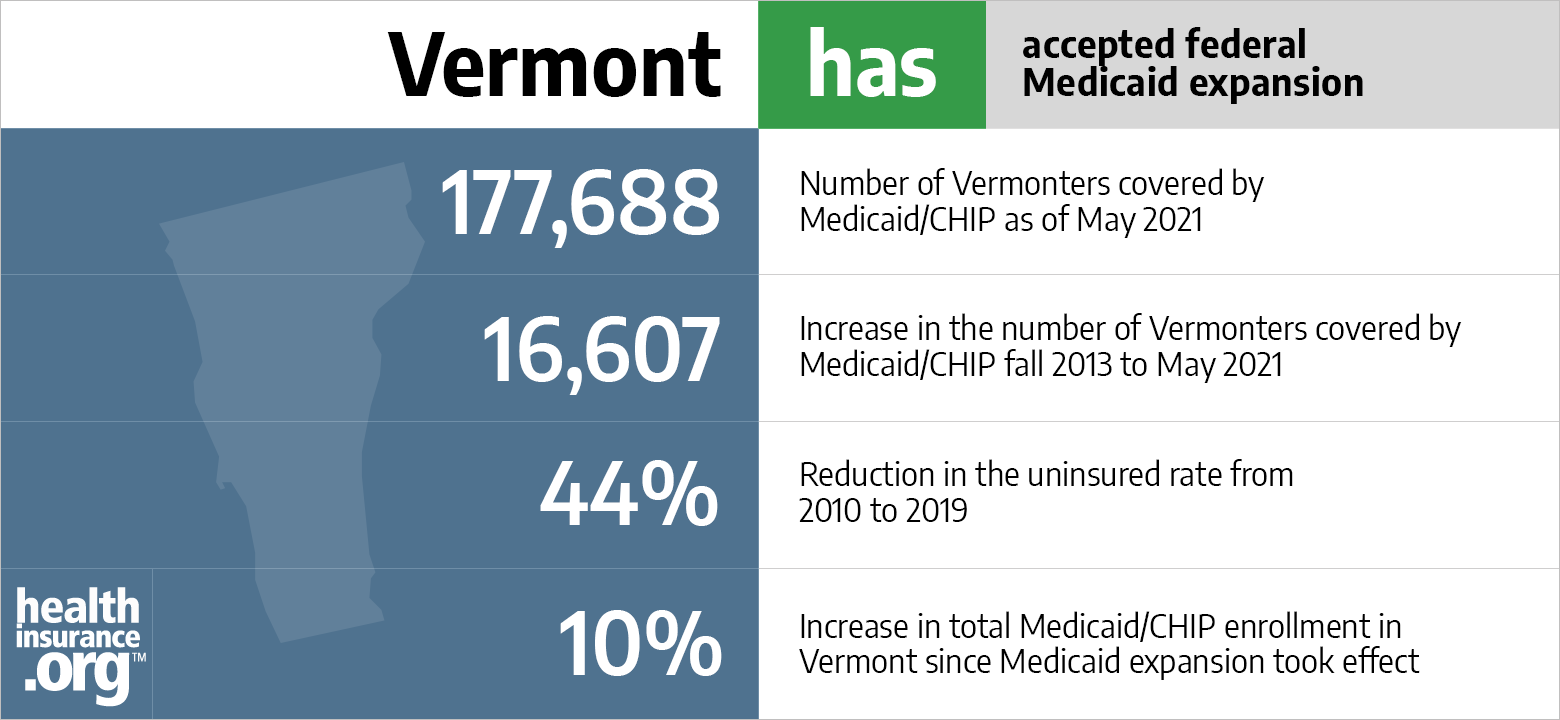

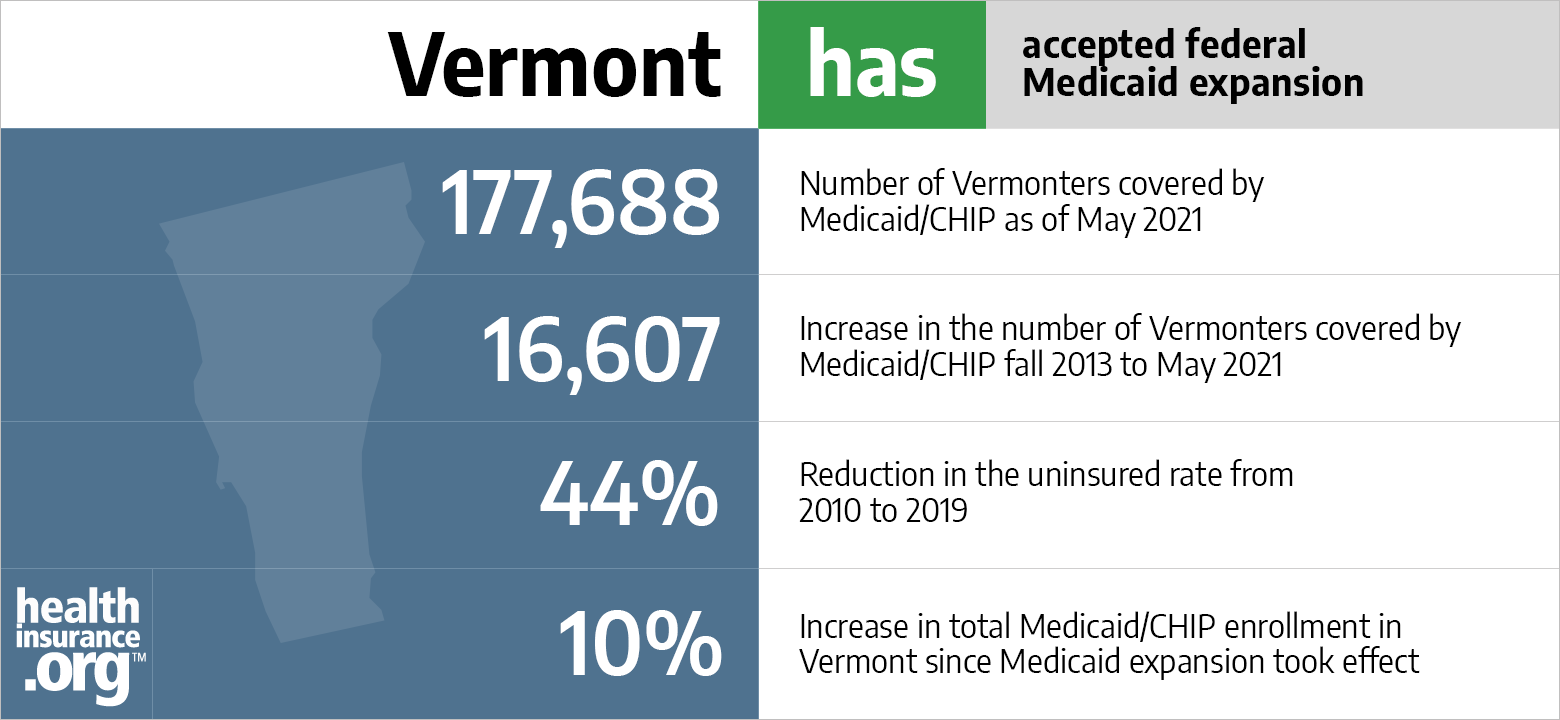

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

Filing A Vermont Income Tax Return Things To Know Credit Karma