capital gains tax changes 2020

In the past you paid your Capital Gains Tax when you completed your Self-Assessment tax return. 2021 federal capital gains tax rates.

Capital Gains Tax Brackets 2021 What They Are And Rates Capital Gains Tax Tax Brackets Capital Gain

PPR relief is.

. The standard deduction increased for inflation. This comes after Chancellor Rishi Sunak asked the OTS to carry out. Top 9 Tax Law Changes for Your 2020 Taxes.

New report suggests doubling CGT rates and slashing the CGT allowance. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15. The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property in the UK.

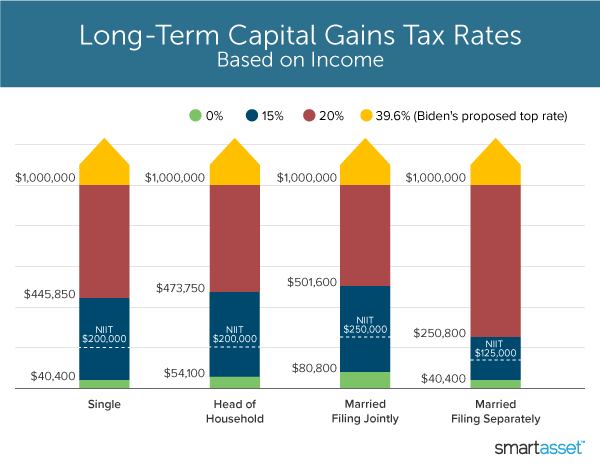

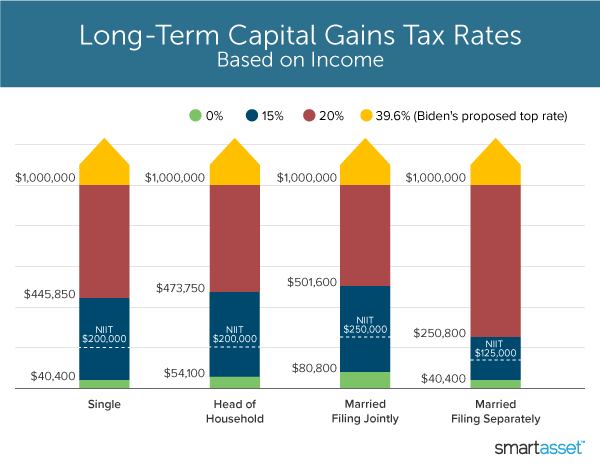

In the 2018 Budget former Chancellor Phillip Hammond announced a couple of changes to the capital gains tax CGT regime and reliefs available to owners of a residential property which was once their main residence. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widower. Capital Gains Tax Rate Threshold 2021 Capital Gains Tax Rate Threshold 2020 0.

Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. At the moment if the property that you are disposing of was once your main residence. This means that different portions of your taxable income may be taxed at different rates.

The capital gains tax CGT system could be made simpler and fairer by reducing the annual exempt amount and raising rates to match income tax according to a recent report from the Office of Tax Simplification OTS. 0 15 or 20. Last years experiment with capital gains reporting was.

The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. The changes which are due to come into effect on 6th April 2020 will have an impact on the CGT liability at the time the property is sold. In 2018 the IRS significantly reduced the Form 1040 completely revising the previous traditional version and introducing additional programs that transmit information to the Form 1040 although the IRS has not changed Form 1040.

Here are a few key tax law changes and other shifts that will affect your 2021 filing. The tax rate on most net capital gain is no higher than 15 for most individuals. Since 6th April 2020 if youre a UK resident and sell a piece of residential property in the UK you now have 30 days to let HMRC know and pay any tax thats owed.

Additional Net Investment Income Tax. For single folks you can benefit from the zero percent capital gains rate if you have an income below 40000 in 2020. IRS Restores Capital Gains Tax and Other Tax Return Changes for 2020 Ready or not the tax return changed again during the 2020 tax season.

For example a single. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

HM Revenue Customs. Much Tighter Payment Terms. As the tables below for the 2019 and 2020 tax years show your overall taxable income determines which of.

Capital gains tax rates on most assets held for a year or less correspond to. Currently any capital gains tax is recorded on an individuals personal tax return and tax is payable on 31 January following the end of the tax year the 5 April. The higher your.

Most single people will fall into the 15 capital gains rate which applies. What were the Capital Gains Tax changes. 2020 Tax Brackets Tax Foundation and IRS Topic Number 559 For Unmarried Individuals For Married Individuals Filing Joint Returns For Heads of Households.

Filing your 2020 taxes will be different due to some stimulus-related legislation and the usual inflation adjustments. SEE MORE Tax Changes and Key Amounts for the 2021 Tax Year However which one of those capital gains rates 0 15 or 20 applies to you depends on your taxable income. RULES FROM 6 APRIL 2020 From 6 April 2020 within 30 days of completion of sale it will be necessary to submit a provisional calculation of the gain to HMRC and pay the tax that is due.

Previously it was not necessary to report or pay CGT until you submitted your. Ad If youre one of the millions of Americans who invested in stocks. Capital Gain Tax Rates.

The tables below show marginal tax rates. It was as a rule paid the following year for instance if you sold a property in the 2018-2019 tax year the payment would be due in 2019-2020 tax year once your SATR had been completed and filed usually by the 31st January. Payable within 30 days.

2020 Tax Rates on Long Term Capital Gains. Capital Gains Tax changes April 2020 1. Now in the Form 1040 for tax year 2019 total capital gains or losses are back on the body of the form Line 6 and not the schedule.

PPR Relief last 9 months. Long-term capital gains are usually subject to one of three tax rates.

What You Need To Know About Capital Gains Tax

Pin By Sam Dogen On Career Work Capital Gains Tax Capital Gain Financial

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What S In Biden S Capital Gains Tax Plan Smartasset

Do I Have To Pay Capital Gains Tax When I Gift A Property The Telegraph In 2022 Capital Gains Tax Capital Gain Setting Up A Trust

What You Need To Know About Capital Gains Tax

Pin By Jackie Kittle On Financials Tax Brackets Capital Gains Tax Capital Gain

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Long Term Capital Gain Tax Rate For 2018 19 Capital Gain Capital Gains Tax What Is Capital

What You Need To Know About Capital Gains Tax

Buy To Let Tax Changes In 2022 Capital Gains Tax Let It Be Buy To Let Mortgage

Tax Planning Services In Delhi Ncr Tax Advisory Company Delhi In 2021 How To Plan Tax Consulting Tax Preparation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)